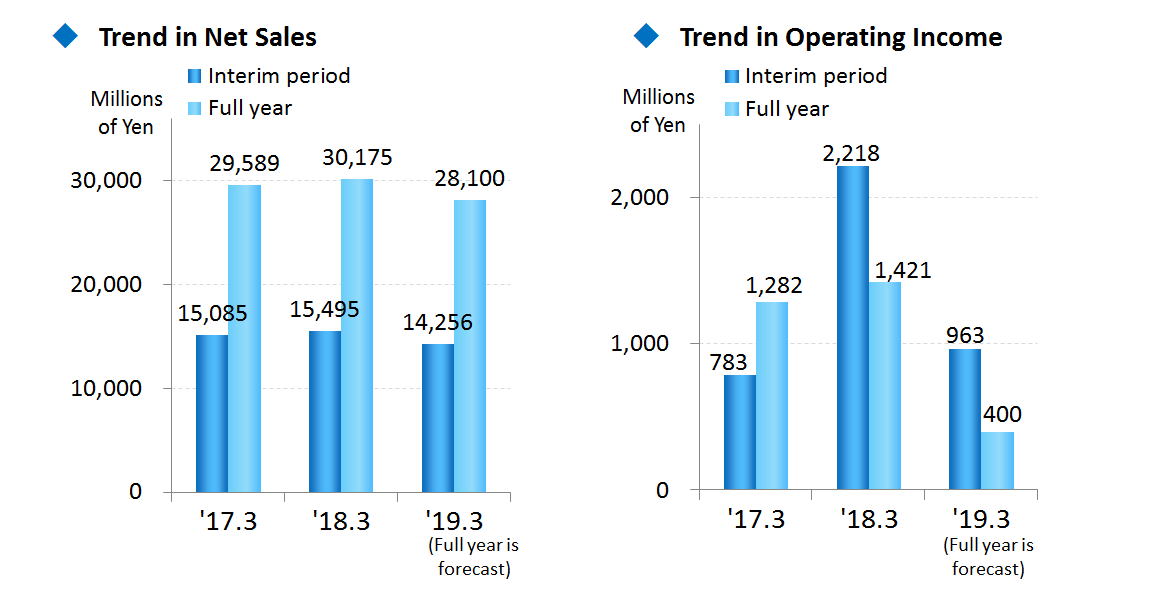

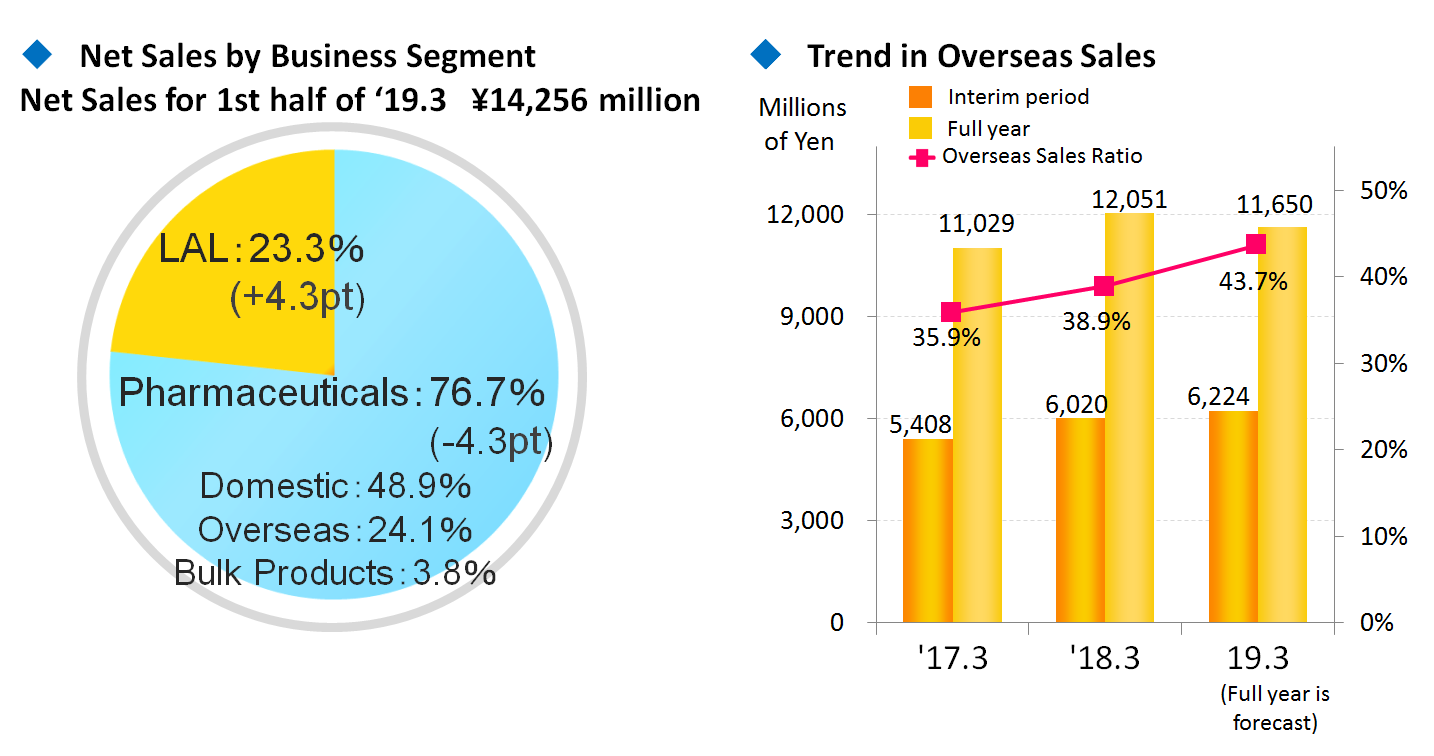

In the first six months (April 1 to September 30, 2018) of the fiscal year ending March 31, 2019 (fiscal 2018), net sales fell 8.0% year on year to ¥14,256 million. The result is attributable to a sharp decline in sales of domestic pharmaceuticals due to the impact of National Health Insurance (NHI) drug price reductions, despite growth from the LAL business in Japan and overseas.

With regard to earnings, although selling, general and administrative expenses were mostly unchanged from the same period of the previous fiscal year, operating income fell 56.6% year on year to ¥963 million, reflecting factors such as the sales decrease and an increase in the cost of sales ratio accompanying NHI drug price reductions.

|

Ordinary income ¥2,475 million (-48.4% year on year ) |

Ordinary income fell 48.4% year on year to ¥2,475 million, reflecting a decrease in royalty income, which more than offset an increase in gain on sale of investment securities, and net income attributable to owners of parent fell 46.1% year on year to ¥1,912 million.

|

Pharmaceuticals Business ¥10,939 million (-12.9% year on year ) |

|

Domestic Pharmaceuticals ¥6,974 million (-17.5% year on year ) |

Amid overall market contraction on a volume basis, deliveries to medical institutions of ARTZ, a joint function improving agent, decreased only slightly thanks to sales expansion measures by the sales partner. The Company’s sales fell sharply, reflecting the impact of NHI drug price reductions implemented in April 2018.

The Company’s sales of the OPEGAN series of ophthalmic surgery aids were at the prior-year level, with SHELLGAN continuing to grow and increases in deliveries to medical institutions and market share compensating for the impact of NHI drug price reductions.

The Company’s sales of MucoUp, a surgical aid for endoscopic mucosal resection, increased thanks to sales expansion measures by the sales partner.

The Company began selling HERNICORE, a treatment for lumbar disc herniation, through sales partner Kaken Pharmaceutical on August 1, 2018. We will strive for a phased rollout while promoting appropriate use. Since fiscal 2018 is the launch year, the Company’s sales are small.

In the U.S., the market environment for hyaluronic acid injectable treatments is becoming increasingly difficult for reasons such as intensifying competition and tightening of reimbursement requirements by some insurance companies. In these circumstances, although local sales and the Company’s sales of Gel-One, a single-injection joint function improving agent, increased, the rate of growth is gradually slowing. Local sales of SUPARTZ FX, a 5-injection joint function improving agent, softened, reflecting the strong impact of tightening of reimbursement requirements, and the Company’s sales declined sharply from a high level in the first half of the previous fiscal year.

Local sales of ARTZ in China (P.R.C.) are on an upward trend, reflecting strengthening of sales expansion activities targeting not only urban areas, but also surrounding areas. The Company’s sales increased year on year, partly reflecting a rebound from a local inventory adjustment implemented in the first half of the previous fiscal year.

Although sales of hyaluronic acid decreased, sales of chondroitin sulfate increased, mainly in overseas markets.

|

LAL Business ¥3,317 million (+13.0% year on year ) |

Sales of the LAL business rose 13.0% year on year to ¥3,317 million as a result of strong domestic and overseas sales of endotoxin-detecting reagents and other products. Overseas subsidiary Associates of Cape Cod is focusing on reinforcing sales operations through measures including switching from selling through distributors to direct selling in Europe, and its sales of endotoxin-detecting reagents and glucan-detecting in-vitro diagnostic reagents are increasing.

| Millions of Yen | Net sales | Operating income | Ordinary income | Net income |

|---|---|---|---|---|

| Fiscal 2018(Forecast) | 28,100 | 400 | 2,250 | 1,700 |

※Although in the first half, the Company reached the full-year earnings forecast in the forecast of consolidated financial results for fiscal 2018 announced on May 11, 2018, in light of factors such as concentration of R&D expenses in the third quarter or later, there is no change to the forecast of consolidated financial results.

※The forecast shown in these materials are based on information currently available and certain assumptions that the Company regards as reasonable. Actual performance and other results may differ materially from these forecasted figures due to various factors.

(As of November 7, 2018)

Related Information