Fiscal 2022 to Fiscal 2025

The Company believes that the business environment will remain uncertain due to rapid changes in the pharmaceutical industry, such as National Health Insurance (NHI) drug price reductions in Japan, system changes in overseas markets, the increasing sophistication of new drug development, rising development costs, and innovations in medical technologies. Also, fulfilment of social responsibilities, starting with sustainability promotion, is increasingly important for the sustainable development of society and enhancement of corporate value, and responding to this societal trend is an urgent matter.

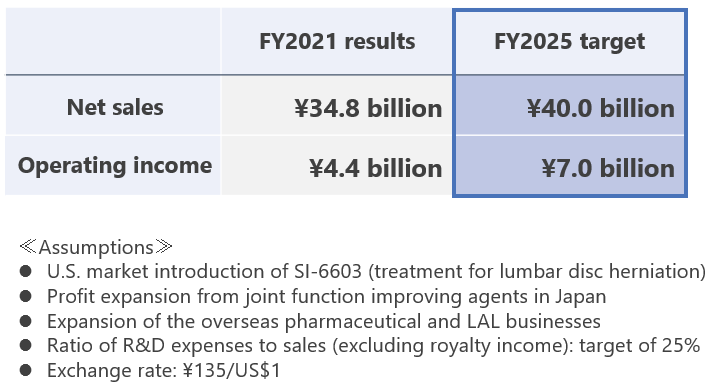

In this business environment, Seikagaku has positioned the four-year period beginning with the fiscal year ended March 31, 2023 (fiscal 2022) as “A period for achieving growth” and formulated a new mid-term management plan. By implementing key measures set out in the plan on the basis of a profit foundation solidified during the period of the previous management plan, Seikagaku will aim to maintain a constant growth trajectory and achieve record-high business results in the final year of the plan.

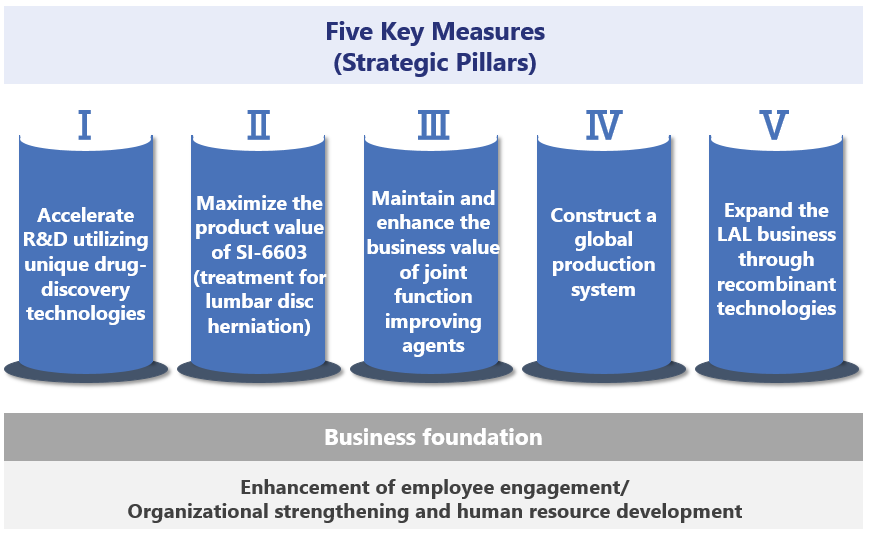

Under the mid-term management plan, Seikagaku positions the plan period as one for solidifying the profit foundation in order to delineate a path to growth once again. To this end, the Company will proceed with the following important measures.

①. Accelerate R&D utilizing unique drug-discovery technologies

Apply Seikagaku’s own GAG*-related basic technologies to create new drugs that patients truly need, with an emphasis on unmet medical needs, by focusing on creation of new development themes in existing fields and creation of innovative research themes, including in new disease areas. Also, to increase the probability of success of these efforts, pursue various alliances aimed at making early progress. At the same time, advance existing pipelines with the aim of obtaining approval and introducing in the U.S. SI-6603 (a treatment for lumbar disc herniation), completing a Phase III clinical study in the U.S. of SI-614 (a treatment for dry eye), and obtaining approval in Japan and initiating a clinical study in the U.S. of SI-449 (an adhesion barrier).

*GAG: Glycosaminoglycans, such as hyaluronic acid and chondroitin sulfate, which are structural components know as glycoconjugates.

②. Maximize the product value of SI-6603 (treatment for lumbar disc herniation)

Take maximum advantage of SEIKAGAKU NORTH AMERICA CORPORATION, established in Canada for the purpose of obtaining approval in the U.S. and launching SI-6603, a treatment for lumbar disc herniation, to ensure a prompt and accurate NDA and response to regulatory review. Also proceed with sales preparations and pursue maximization of product value through early penetration at medical institutions in close cooperation with the sales partner.

③. Maintain and enhance the business value of joint function improving agents

Strive to maintain and enhance the business potential of the core products that support business management by increasing the presence of Seikagaku products in the mainstay domestic market for joint function improving agents. Since the domestic pharmaceuticals business is greatly affected by NHI drug price reductions, cost structure improvement is essential. Seikagaku will further proceed with product material specification changes, which help ensure continuity of product supply, manufacturing process efficiency improvement, and other measures. Seikagaku will also continue gathering and providing safety information on the joint function improving agent JOYCLU with the aim of contributing to appropriate prescription on the basis of clinical research findings.

④. Construct a global production system

Further reinforce a stable supply of products on the basis of an appropriate and efficient production system by making Dalton Chemical Laboratories, Inc.(Toronto, Canada) and the Seikagaku Takahagi Plant (Ibaraki Prefecture, Japan) dual production bases, including transfer of production of some products.

⑤. Expand the LAL business through recombinant technologies

Aim to create new value in cooperation with overseas subsidiary Associates of Cape Cod, Inc. by accumulating reliable scientific data utilizing PyroSmart NextGen recombinant LAL reagent and promoting development of new diagnostic reagents utilizing recombinant technologies and by developing and improving measurement equipment and software in collaboration with an affiliated company.

In addition, enhancement of employee engagement along with organizational strengthening and human resource development will be critical factors for carrying out the above five key measures. Seikagaku will work to solidify and improve the foundation for achieving sustained growth by stepping up the development of human resources, the heart and soul of the Group’s businesses, and actively investing to create an environment that promotes employee growth.

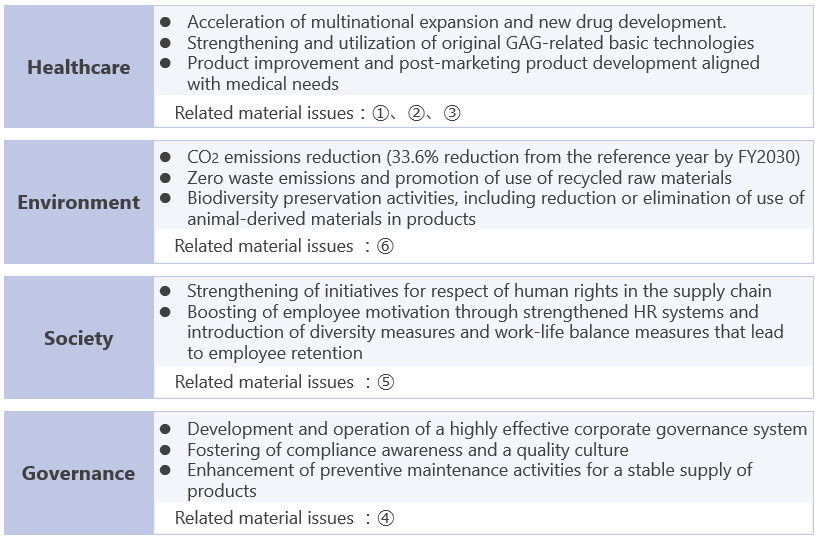

Seikagaku has identified six material issues as important issues that should be addressed on a priority basis in the interest of achieving sustainable development of society and enhancement of corporate value. Seikagaku will continue to focus on these material issues, which will become the foundation for the key measures in the mid-term management plan, strengthen development of medical-related businesses as well as ESG (Environment, Social, Government) initiatives, and aim to contribute to solving social issues through close communication with supply chain partners and stakeholders.

Details on initiatives relating to materiality and sustainability are available on the Seikagaku corporate website.

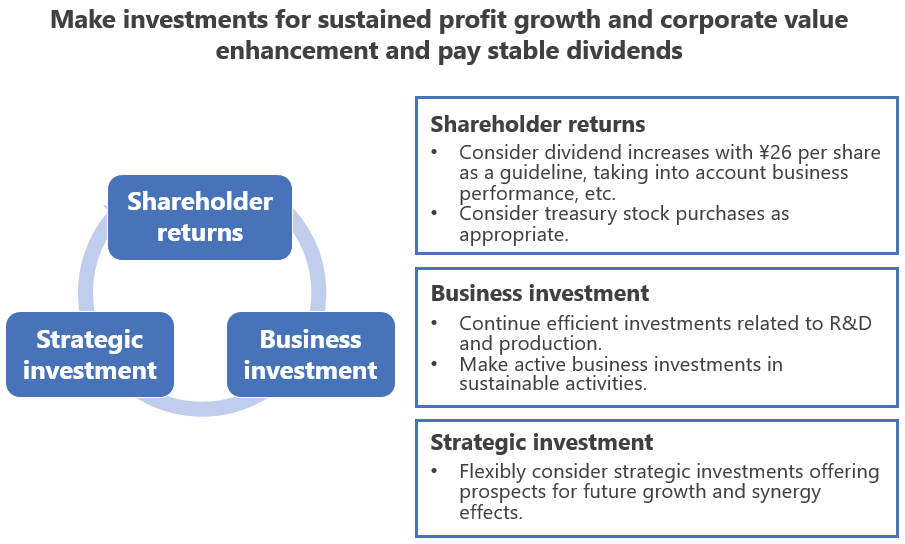

In conjunction with formulation of the new business plan, Seikagaku has established a new basic policy on profit distribution, as set out below.

Basic policy on profit distribution

Seikagaku believes that sustained profit growth and enhancement of corporate value contribute to the common interests of the shareholders. Seikagaku regards the return of profits to shareholders as an important management priority and, while taking an annual dividend of \26 per share as the basis, will consider dividend increases, taking into account the trend in business performance, the financial position, and other factors. Also, while taking into consideration future business expansion and the total return ratio, Seikagaku will consider, as appropriate, the purchase of treasury stock.

In addition, in order to solidify the business foundation and improve capital efficiency, the Company will make efficient and active business investments in R&D for creating new value, production system development, and sustainable activities and will flexibly make strategic investments offering prospects for future growth and synergy effects.

■Presentation Materials