We considers addressing climate change to be an important management priority and are implementing measures to combat climate change. Since June 2022, we have disclosed the status of our responses to TCFD* recommendations as well as to climate-related risks and opportunities.

*The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in December 2015 at the request of the G20 Finance Ministers and Central Bank Governors Meeting to examine climate-related information disclosure and the response of financial institutions to climate change.

In its final report, published in June 2017, the TCFD recommended that companies and other organizations disclose information on climate change risks and opportunities in the areas of governance, strategy, risk management, and metrics and targets.

In accordance with the Basic Policy on Sustainability, the Company has identified by a resolution of the Board of Directors important issues that should be addressed on a priority basis (materiality) in the interest of achieving sustainable growth for Seikagaku and realizing a sustainable society.

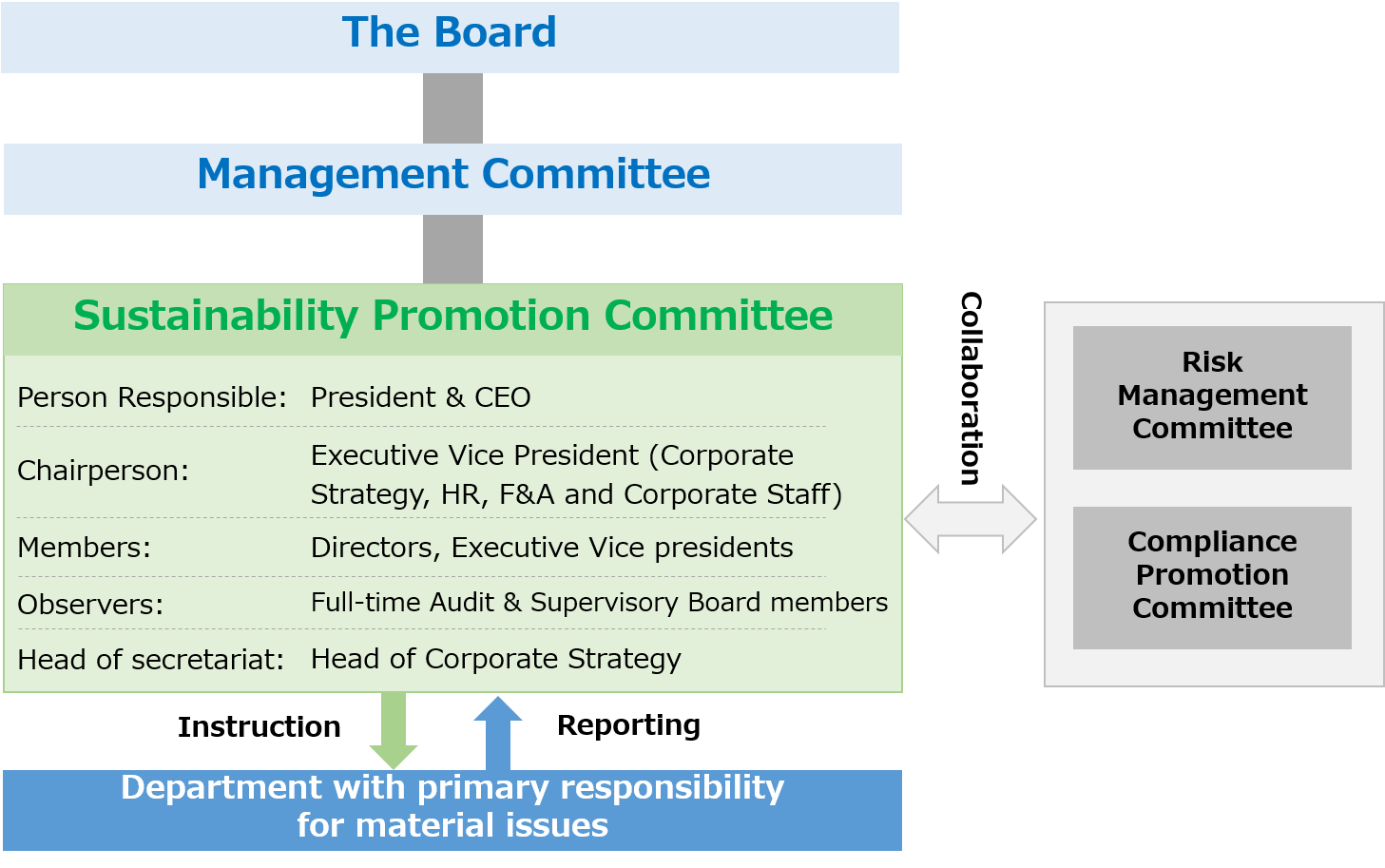

We established the Sustainability Promotion Committee for the main purpose of addressing sustainability-related issues. In principle, the Committee meets twice a year to discuss the action policy for climate change issues, promotion measures, and related matters and to examine and assess progress. Also, climate change risks and opportunities are included among the group-wide risks evaluated by the Risk Management Committee, discussed by the Sustainability Promotion Committee, and reported to the Board of Directors, and the Board monitors and oversees progress in addressing these risks. The president and CEO serves as the officer responsible for the Sustainability Promotion Committee and Risk Management Committee.

To conduct a climate-related risk and opportunity materiality assessment, we used the following scheme to identify and assess scenarios for three categories: transition risks, physical risks, and opportunities. In addition to the scenarios proposed by the Intergovernmental Panel on Climate Change (IPCC)*1 and the International Energy Agency (IEA)*2, we carefully examined internal and external information and assessed the potential effects of climate-related risks and opportunities on businesses, strategy, and financial planning.

- Step1Collection and analysis of basic information on climate change

- Step2Climate change scenario hypotheses setting

- Step3Risk and opportunity analysis for each scenario

- Step4Qualitative assessment of financial impacts

Transition risk

|

Risks and Opportunities |

Details |

Scale of Financial Impacts |

Timeframe |

Response and Resilience |

|---|

|

Policy and legal risk |

Rising costs due to tightening regulations, such as introduction of a carbon tax |

Medium / Medium |

Medium to long term |

Mitigation of carbon tax burden through promotion of energy conservation as well as introduction and expanded use of renewable energy; cost reductions from initiatives such as reduced raw materials use |

|

Market risk |

Rising costs due to adoption of eco-friendly raw materials, etc. |

Medium / Medium |

Medium to long term |

Mitigation of carbon tax burden through promotion of energy conservation as well as introduction and expanded use of renewable energy; cost reductions from initiatives such as reduced raw materials use |

|

Reputation risk |

Departure of investors and fewer opportunities to secure personnel due to inadequate sustainability disclosures, etc. |

Medium / Small |

Short to medium term |

Pursuit of corporate value enhancement and increased opportunities to secure investment and personnel through proactive sustainability disclosures |

Physical risk

|

Risks and Opportunities |

Details |

Scale of Financial Impacts |

Timeframe |

Response and Resilience |

|---|

|

Acute |

Risk of damage to production facilities, etc. resulting from increasingly extreme weather events; rising costs for restoration and prevention measures; temporary shutdowns due to supply chain disruptions |

Medium / Large |

Medium to long term |

Damage minimization through continuous reviews of the business continuity plan (BCP) and enhanced BCP measures along with strengthened impact assessment and response capabilities along supply chains |

|

Chronic |

Declining outpatient numbers due to a healthcare crunch |

Medium / Medium |

Long term |

Promotion of R&D of long-acting drugs that entail little outpatient burden |

|

Chronic |

Decrease in natural resources used as raw materials or quality deterioration due to the impact of climate change on ecosystems |

Small / Medium |

Medium to long term |

Promotion of research of substitute raw materials and transition from biological to recombinant raw materials, such as fermented materials |

Opportunities

|

Risks and Opportunities |

Details |

Scale of Financial Impacts |

Timeframe |

Response and Resilience |

|---|

|

Energy and resource efficiency |

Production facilities efficiency improvement |

Small / Small |

Medium to long term |

Cost reductions from promotion of energy conservation and introduction and expanded use of renewable energy |

|

Products, services, and markets |

Climate-change related spread of infectious disease |

Medium / Medium |

Long term |

Promotion of R&D in the infectious disease diagnosis field, etc. |

In risk management, each division and department implements initiatives in response to risks and opportunities in accordance with the Corporate Risk Management Regulations. The Sustainability Promotion Committee, established in December 2021, and the Risk Management Committee share information on climate change risks, integrate and manage these risks as a form of business risk, and periodically report important risks to the Board of Directors.

・46% reduction by 2030(Scope1+2, compared to FY2017)

・Pursuit of carbon neutrality by 2050

・Scope3 calculation(Disclose by 2025)